Big Data Analytics in Bangladesh and insurance Sector

|

| Bigdata Analytics |

Here

is a brief timeline of the development of big data analytics in Bangladesh:

2014:

The Bangladesh Association of Software and Information Services (BASIS)

organized a seminar on big data to raise awareness of the technology among

businesses and entrepreneurs in Bangladesh.

2015:

The Bangladesh government launched the Digital Bangladesh 2021 strategy, which

included a focus on the development of big data analytics. The strategy aimed

to promote the use of data analytics in various sectors, including healthcare,

education, and finance.

2016:

The Bangladesh Institute of ICT in Development (BIID) conducted a study on the

potential of big data analytics in Bangladesh. The study identified

opportunities for the application of big data analytics in various sectors,

including agriculture, health, and transportation.

2017:

The International Data Corporation (IDC) predicted that the big data and

analytics market in Bangladesh would reach $29.3 million by 2020.

2018:

Grameenphone, the largest mobile phone operator in Bangladesh, announced that

it had partnered with a data analytics company called Telenor Connexion to

develop a new data analytics platform. The platform was designed to help

Grameenphone analyze customer data to improve its services and marketing

efforts.

2019:

The Bangladesh Telecommunication Regulatory Commission (BTRC) launched a new

platform called the Telecommunications Big Data Analytics Platform to analyze

data from the country's telecommunications industry. The platform was designed

to provide insights into consumer behavior and to help businesses and

policymakers make more informed decisions.

Overall,

the adoption of big data analytics in Bangladesh is still in its early stages,

but there have been significant developments in recent years. With initiatives

such as the Digital Bangladesh 2021 strategy and the Telecommunications Big

Data Analytics Platform, it is likely that more businesses and organizations in

Bangladesh will adopt big data analytics in the coming years to gain insights

and improve decision-making processes.

The

adoption of big data analytics in the insurance industry in Bangladesh is still

in its early stages, but there have been some significant developments in

recent years. Here is a brief timeline of some of the key events:

2016:

Green Delta Insurance, one of the leading insurance companies in Bangladesh,

announced that it had launched a new data analytics unit. The unit was tasked

with analyzing customer data to improve underwriting, claims management, and

customer service.

2018:

MetLife Bangladesh, a subsidiary of the global insurance company MetLife,

announced that it had partnered with a data analytics company called Clarifai

to develop a new data analytics platform. The platform was designed to help

MetLife Bangladesh analyze customer data to improve its underwriting and claims

management processes.

2020:

Pragati Life Insurance, one of the fastest-growing insurance companies in

Bangladesh, announced that it had partnered with a data analytics company

called Analyzen to develop a new data analytics platform. The platform was

designed to help Pragati Life Insurance analyze customer data to improve its

underwriting, risk management, and customer service processes.

|

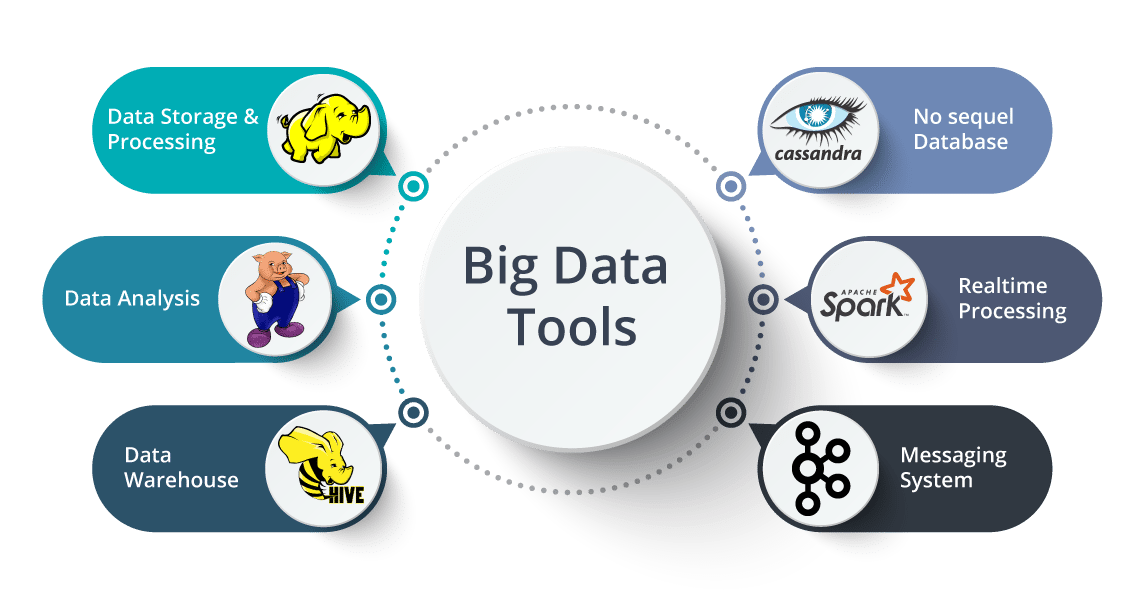

| Bigdata Analytics Tools |

Overall,

the adoption of big data analytics in the insurance industry in Bangladesh is

still in its early stages, but there is growing interest in the potential

benefits of the technology. As more insurance companies in Bangladesh recognize

the value of analyzing customer data to improve underwriting, risk management,

and claims management processes, it is likely that we will see more

developments in the use of big data analytics in the insurance industry in

Bangladesh in the coming years.

Comments

Post a Comment

Please do not enter any spam link in comment box.